Never Let a Good Earnings Season Go to Waste

portfolio update

Hello,

Welcome to another portfolio update. As you’ve probably noticed by now, unlike other investing blogs, I prefer to write these not right after the quarter ends but once all of the stocks I hold have reported their quarterly numbers.

The main reason is that I believe portfolio performance between earnings seasons is usually driven more by sentiment and other non-thesis noise—none of which says anything about whether my fundamentally driven theses are on track. I’ve also noticed that earnings season is often when most of my yearly outperformance or underperformance takes place.

I also find this applicable to any portfolio made up mostly of illiquid global micro-caps with (much) lower beta than the market. The ones that don’t really care about passive flows or whether the MAG7 and SPY are up or down on the year.

This lower correlation to broad indices is also a big reason why I have no trouble staying fully invested almost all the time, even though I think stocks in general are very expensive right now and don’t offer great risk-reward going forward—aside from a scenario where high inflation doesn’t crush consumer confidence and large American enterprises manage to squeeze out another season of strong pricing power.

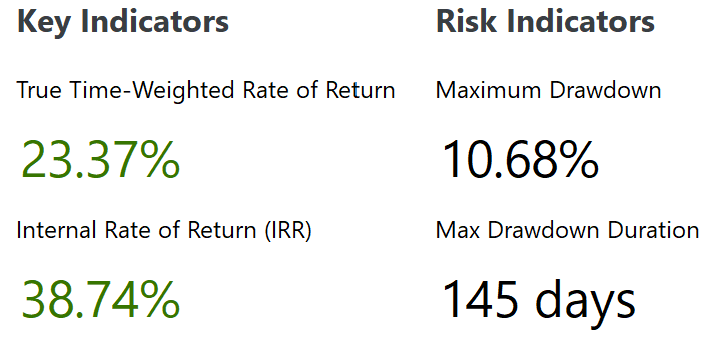

In H1 2025, the portfolio was up 11% on the year, and as of August 24th, it’s up 23% YTD. Both are measured in EUR and reflect pre-tax performance.

I’m also pleased to report that 6 out of 12 of my holdings are up more than 30% YTD—measured either from the start of 2025 or from the time I pitched them this year if the position was initiated more recently. Only 1 of the 12 holdings I currently own, and 2 of the 17 names I’ve been involved with during the year, have posted negative performance YTD (or during my holding period if bought this year). And the main drag on my overall performance has been the USD holdings, since they were bought with EUR income.

That’s all I’ll say on portfolio performance, as I don’t want to be in the business of writing detailed commentary on stock moves each quarter—especially not on a random date in August. It’s not something I pay much attention to, nor do I think others should. That said, I will be writing a more detailed piece on performance in January, since it will mark the third anniversary of me sharing my analysis and real-time portfolio moves publicly. And a three-year time frame usually means a lower luck factor than a three-month time frame.

So for now, let’s stick to what actually matters: the key fundamental and thesis developments, how the current risk-reward looks, and what matters for the thesis going forward—along with a snapshot of my position sizing as of August 24th, 2025.